Growth of low-cost sparkling wines in 2022

Wine consumption in Italian households is changing: in 3 years, bubbles record +17% while still reds drop to -11%. According to the UIV-Ismea Observatory, the only category growing in large-scale retail sales in 2022 is low-priced sparkling wines.

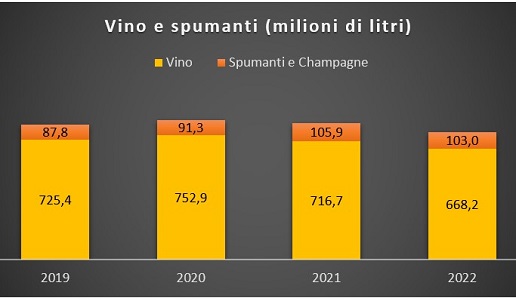

It closes a year of repositioning for wine sales in large-scale distribution (and retail) in Italy. In 2022, the only clearly positive item - notes the Uiv-Ismea Observatory based on the Ismea-Nielsen IQ Observatory - relates to the category "Other Charmat sparkling wines" (other than Prosecco), which archived 2022 with a trend growth in volume of 13 percent (+22 percent in discount stores), in the face of an overall decline in shelf purchases exceeding 6% with above-average losses for the still wine type (-7%) and particularly for red DOCs, which fell in double digits (-11%). The exploit of low-cost sparkling wines-whose average price at 4.4 euros/liter registers a much smaller increase in list prices than its competitors-is a mirror of the limited purchasing power of Italians in the last year (the most expensive classic-method sparkling wines close-after a 2021 to be framed-at -9%, Champagnes at -25%, also due to limited availability) but at the same time highlights all the now indispensable centrality reached by bubbles even at home. The 2022 balance of sales in large-scale distribution also closes at a loss on the value front (-2%, to 2.94 billion euros).

Focus 2022 vs 2019

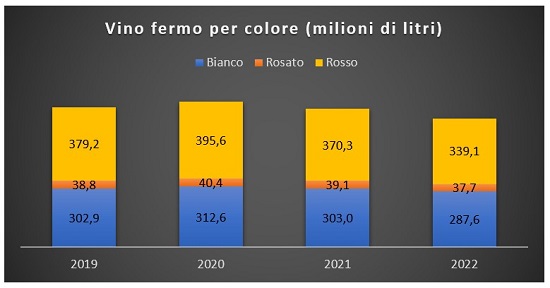

According to the Observatory of the Italian Wine Union and Ismea, from 2019 to 2022 bubblies recorded an increase in volumes marketed in large-scale distribution of 17 percent, with even sharper growths for Prosecco (+31 percent) and "Other Charmat sparkling wines," which closed the three-year period at +32 percent (34 million bottles in 2022). For the secretary general of Unione italiana vini, Paolo Castelletti: "The gap between the performance of sparkling wines and the rest of the market is increasingly evident, and the effect has been far from neutral. Paying the costs of a trolley that sees sparkling wines as the protagonists of daily consumption is probably still wine (-8 percent) and in particular reds, which in the period under consideration are experiencing an 11 percent contraction."

For the head of Ismea's Rural Development Services Directorate, Fabio Del Bravo: "What we observe from the immediate pre-Covid period to today is a change with few precedents in the consumption habits of Italians, who now consider sparkling wines a wine for the whole meal, untethered from festivities and holidays and which they are not willing to give up even in the face of erosion of purchasing power."

Denominations of Origin

While obviously the last year's balance of the main appellations and geographical indications follows the general negative trend, a look at the medium-term perspective helps to better frame which wines have structurally entered a regressive phase and which are falling back to pre-Covid values after the 2020/21 flare-up. Among the former, a number of Igt reds should be counted, whether from native or international grape varieties. Among PDOs, the setbacks are numerous and range from Piedmont to Sicily. Those in the process of returning to "normality" are instead Montepulciano d'Abruzzo, Chianti, Salento (hence Negroamaro), Lambrusco Emilia and Rubicone Trebbiano. Then there are also those (few actually among the big sellers) in a positive phase, despite negative volumes in the last year: Sangiovese Rubicone, Vermentino di Sardegna, Verdicchio, Castelli Romani, Valpolicella.

E-commerce

The heaviest negative balance in volume (2022 vs. 2021) can be found in e-commerce, with -15% cumulative among wines and sparkling wines and higher peaks for the most valuable types, such as classic method sparkling wines (-21%). The channel, as opposed to physical retail, experienced widespread negative price signs, with price lists averaging -10%. After experiencing a real boom in sales in 2020 (from 2.6 to 8 million liters) and a further increase in 2021 (9 million), the segment seems destined to settle down to the levels of the pandemic year, and thus to have stopped growing.

Italiano

Italiano